Originally posted on projin.co.kr

In late December, Deron Brown was having trouble finding a hotel room in Phoenix for a January conference. And from his perspective, that was a good thing.

As president and chief operating officer of U.S. operations for Edmonton, Canada-based PCL Construction, Brown constantly tries to read the tea leaves of where construction markets are headed.

As 2021 turned into 2022, many of those signs indicated it was at least in the right direction.

Beyond the lack of hotel rooms in Phoenix — a signpost for Brown that “people are getting back out there and doing things” — he’s noticed a distinct change in the tenor of PCL’s clients across its buildings, industrial and civil divisions. Namely, they’re no longer lollygagging when it comes to committing to projects.

“The key is whether people are actually pulling the trigger and signing contracts,” said Brown. “Over just the last couple months, we see people doing that.” For example, while hospitality construction has been one of the hardest hit sectors of the pandemic, PCL had at least six hotels in various stages of development and construction at the beginning of 2022.

Deron Brown

Courtesy of PCL Construction

“We have a lot of developers and hoteliers who are wanting to build,” Brown said. “Their estimating and pre-con departments are very busy.”

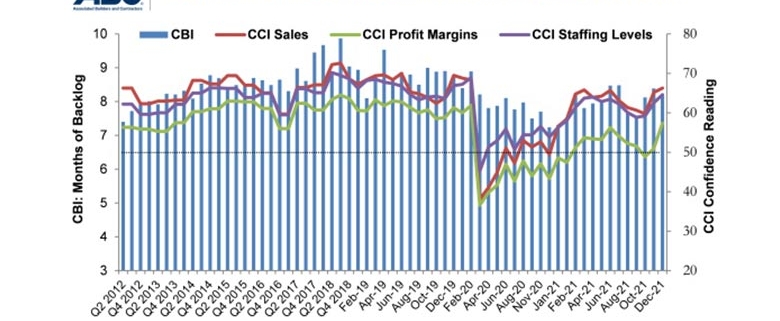

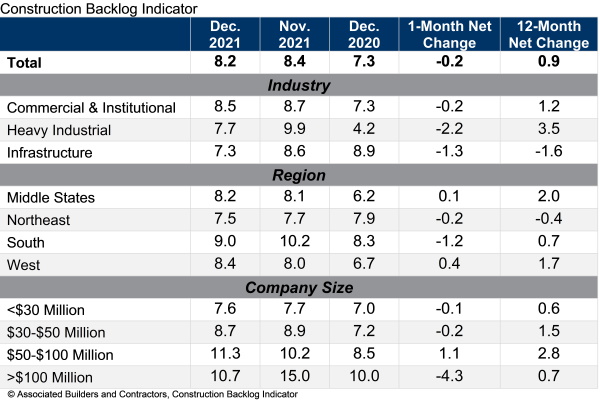

Indeed, across the four regions where PCL operates — Canada, Australia, the Caribbean and the U.S. — the firm had a record backlog at the end of 2021. For Brown, it all adds up to a robust outlook for the year ahead.

“We do see a strong construction market for 2022,” said Brown. “Some areas are still hurting, but a lot of other areas are very strong.”

Brown and PCL aren’t alone in that tentative, but rebounding, new year’s forecast.

NERVOUS OPTIMISM ON PRICING

Construction pros and economists are taking a cautious but more hopeful view on the year ahead, even in the face of the highest rate of inflation since 1982, material price surges, continuing supply chain snarls and the exploding COVID-19 omicron variant.

While these market observers still see plenty of challenges ahead in the sector — the endemic labor shortage being top among their concerns — their perspective at the beginning of the year marks a return, if not to normal, at least a resemblance to the pre-pandemic world.

Ken Simonson

Courtesy of Associated General Contractors of America

“Looking at 2022, I would say I’m nervously optimistic,” said Ken Simonson, chief economist for the Associated General Contractors of America. “Nonresidential construction, by and large, seems to have passed the low point and is on an upswing.”

For Simonson, that nervous optimism is based, at least in part, on some commodity prices coming back down at the end of 2021.

He pointed to copper’s 10% dip in December – though it started to blip up again in January – and hot-rolled coiled steel giving back 20% since its peak in September. Lead times for deliveries of materials were also shrinking, he said, a factor that should put further downward pressure on prices.

“I’ve gotten more optimistic about material prices,” Simonson said. While he doesn’t expect them to return to pre-pandemic levels, he anticipates more up and down volatility, which is better than the exclusively upward cost trajectory many material prices took through to the summer of 2021.

His bigger concern is continued threats from COVID-19, including omicron, the ever-changing vaccine mandate landscape and heightened vaccine hesitancy among construction workers, compared to other industries.

“It means there is a much greater risk for severe illness from COVID, and depending on what mandates are in effect, it adds to the difficulty construction firms will have fielding a full, healthy and eligible workforce,” Simonson said.

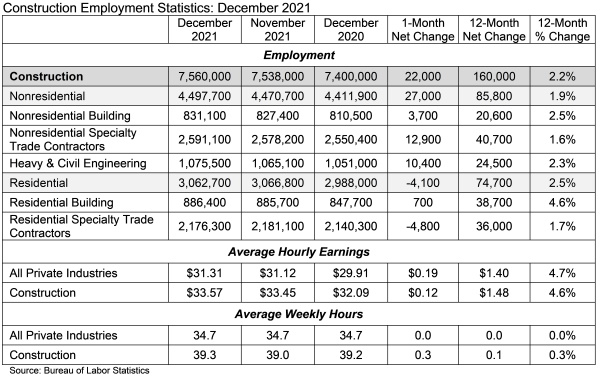

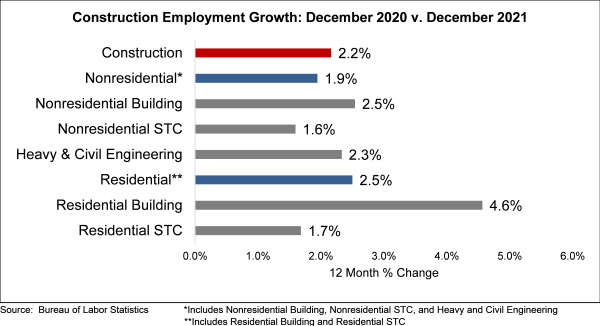

Those challenges add to the already endemic labor shortage in construction, where there were 345,000 unfilled jobs at the end of November. That was actually down from October, when openings hit an all-time high of 455,000, but up from 261,000 a year earlier, a 32% jump, according to the Bureau of Labor Statistics.

THE BENEFITS OF INFLATION

Yet, as some of construction’s biggest challenges converged in 2021 — namely rising prices and fewer workers — there’s also reason to believe that they might conspire to contractors’ benefit in the year ahead.

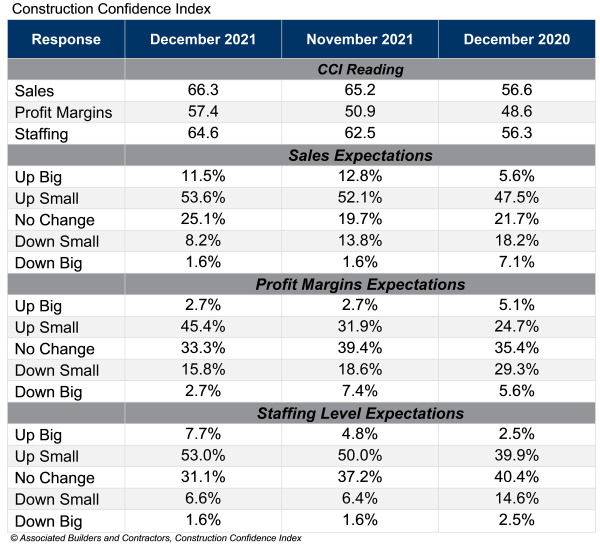

That’s the view of Anirban Basu, chief economist at Associated Builders and Contractors, when he looks at surging inflation in the economy as a whole — it rose 6.8% year-over-year through November 2021 — and the number of workers who are still sitting on the sidelines.

Anirban Basu

Permission granted by Associated Builders and Contractors

“Inflation is real. It’s not particularly transitory,” said Basu, countering the Federal Reserve’s view for much of last year that rising prices were temporary, before it pivoted to a more hawkish stance in December and signaled it would start increasing interest rates in 2022. “More and more people will have difficulty paying their bills.”

The silver lining of those increases is that they may very well force people to go back to their jobs. “That might induce them back into the labor market, which I think would be a positive,” Basu said. “It’s time to get back to work.”

Another looming advantage of rising prices is that it has put pressure on developers to lock in contracts now, before costs can go higher, and get their projects in the pipeline while contractors still have bandwidth. That’s a factor that Brown sees incentivizing his clients to move forward as well, especially as the pandemic recedes.

“There’s some confidence that we don’t have this thing beat yet, but we’re moving in the right direction,” Brown said in reference to COVID-19. “And to build a project, you don’t build it in a day — you build it in a year and a half, or two years. So people are starting to think that if they wait, they may miss the right opportunity to build their project.”

MANUFACTURING’S LONG JOURNEY HOME

For Richard Branch, chief economist at Dodge Data & Analytics, labor also figures into the biggest challenges facing construction in 2022, a trifecta he calls the “3 Ps” of “people, prices and productivity,” with the last hurdle referring to trying to do more work with fewer resources.

But he also sees evidence that construction might enjoy some tailwinds due to adjustments firms have made due to the very challenges COVID-19 has thrown at the country.

Richard Branch

Courtesy of Dodge Data & Analytics

A case in point is manufacturing, where a movement toward “onshoring” to overcome far-flung supply chain tangles overseas has led producers of goods not only to start ramping up their existing production volumes, but also to build new facilities to pump out more product.

Indeed, it was the manufacturing sector — not warehouses, not healthcare, not other nonresidential buildings — that blew the doors off construction starts in 2021, increasing by 86%, according to Dodge’s data.

Nonresidential Building Starts YTD Through November Each Year, in Billions

| Sector |

2020 |

2021 |

Change |

| Manufacturing |

$14.4 |

$26.7 |

86% |

| Warehouse |

$31.6 |

$40.5 |

28% |

| Other Nonres Building |

$55.4 |

$62.6 |

13% |

| Retail |

$11.5 |

$12.8 |

12% |

| Health Care |

$25.5 |

$27.0 |

6% |

| Education |

$57.5 |

$56.7 |

-1% |

| Office |

$40.1 |

$35.6 |

-11% |

| Total |

$236 |

$262 |

11% |

SOURCE: Dodge Data & Analytics

“The good news is we are starting to see factory output come back to close to where it was prior to the pandemic,” Branch said. “That should help the supply side, and if we start to see some improvements with the log jams at ports, perhaps by the back side of 2022, we might see some reprieve from these higher prices.”

MORE HOARDING AHEAD?

Until that comes, however, there’s another outlier that concerns construction watchers, and that’s an increase in stockpiling of materials in yards and warehouses by contractors, simply to have them, should a job materialize where they can be used.

It’s a trend Brown has picked up on as he goes out to compete for the increased amount of contracts he’s seeing in the marketplace.

“Remember when the pandemic hit and everybody stockpiled toilet paper? That’s happening today with businesses and materials,” Brown said. “People are stockpiling three months of piping, or whatever it may be.”

That has compounded the problem of availability and delayed deliveries.

“Some of it is a shortage, and some of it is shipping, but some of it is still a little bit of fear, where people are buying products to try to protect themselves,” Brown said. “That’s driving up the demand, which does not help the overall industry.”

Craig Tappel, chief sales officer in the construction practice for Chicago-based surety brokerage Hub International, said he’s seen that among his clients as well.

Craig Tappel

Courtesy of HUB International

“They’re trying to build stockpiles so that they have their own supplies, and that’s adding to the shortages,” Tappel said.

It also introduces another element of risk that contractors need to be aware of.

“If it’s not assigned to a particular jobsite, and it’s not part of materials headed toward a particular project, it’s not automatically covered under that builder’s risk policy,” Tappel said. “So you’ve got to think about that. What are you doing to mitigate that risk?”

It’s a question contractors will need to answer as they as they navigate the tenuous recovery expected for 2022.